Audio transcription:

Warning: this article offers financial advice given by a non-professional – I’m a dancer and a writer with an aversion to math. Nico is a graphic designer/artist and also terrible at math. A retired financial journalist (my mother, Anne Swardson) was consulted, as well as choreographer and Master of Economics Cécile Bally. Therefore this journey is an experiment offered from lived experience and curiosity, with Venus in Capricorn, and a friendly relationship with money. Use good judgement.

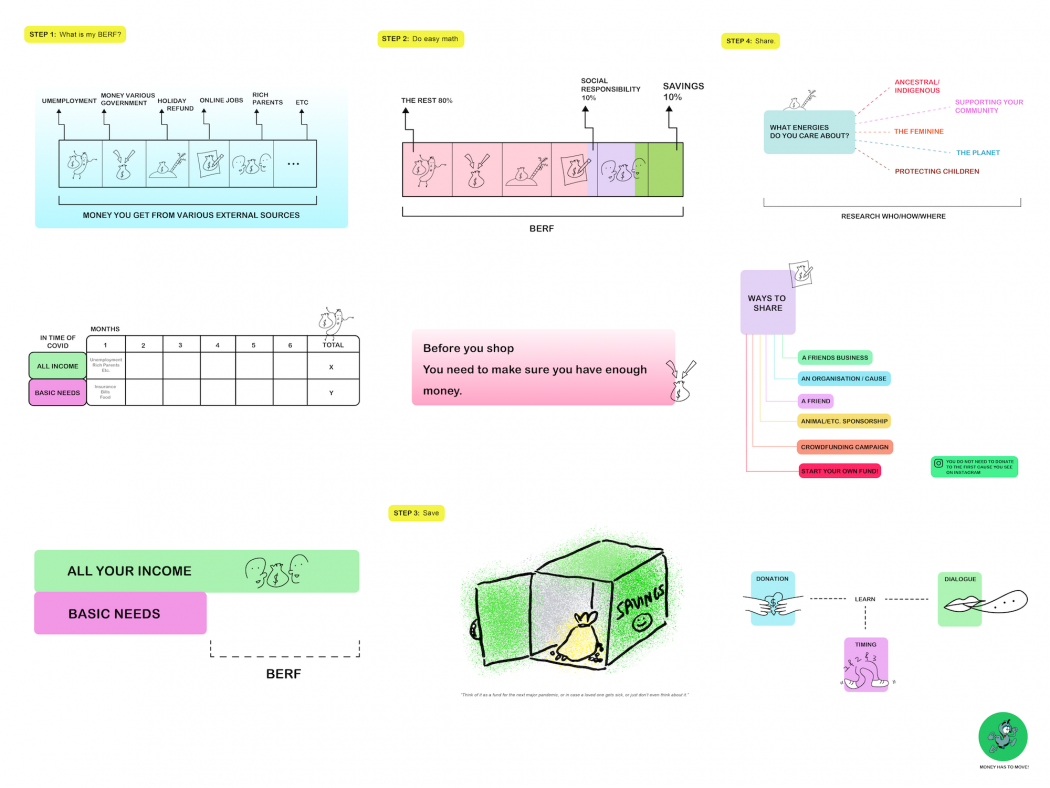

This is a choose-your-own-adventure and how-to guide on sharing and saving money. It is intended to help you figure out whether you can afford to share money, and to encourage you to save money. If you can afford to share your resources, this guide will help you determine how much, to whom, and when to do it.

The byproduct of figuring this out is that you will get to know your financial “personality” better. The process of being involved with your money, facing fears around lack, survival, self-worth, guilt, control, etc. is really important. No matter what you end up doing with the info in this guide, I hope you take ownership of your financial situation and get familiar with the specifics of what you can do, what you need to do more of, and what is just fine for now. If you want to learn more, Paco is an amazing queer financial advisor with a free newsletter and tons and tons of free resources for freelancers and small businesses.

Facts:

- This pandemic makes everything more precarious than it already was, for everyone.

- This is a time when people are looking out for each other more than usual.

- Some people around the world have seen a surge of money in the past weeks – which is great because maybe more things are possible than they were, but it can also be destabilizing!

When you have a lot of money all of a sudden, it can feel a bit weird and be un-grounding 7000 €.

starts to feel like 100 000€. Be wary of this! By figuring out how much you can afford to save and share (neither of which ‘take’ anything away from you energetically) you will be looking at a more manageable sum of money to spend, which might make you feel more level-headed. Also – perhaps 7000 € is actually not enough to last you six months. We are going to clarify, as much as possible, what your money means in the pandemic. Follow the steps to figure out how.

Let’s take a look at how the pandemic may have affected your income:

You have shifted to home office and your expenses are much, much lower than usual. You got reimbursed from a cancelled flight. Your parents gave you money. Your landlord cancelled half your rent, but you lost all your jobs so you still can’t afford it. You have to pay some of your student loans, although the public ones got paused. You are going on unemployment for the first time.

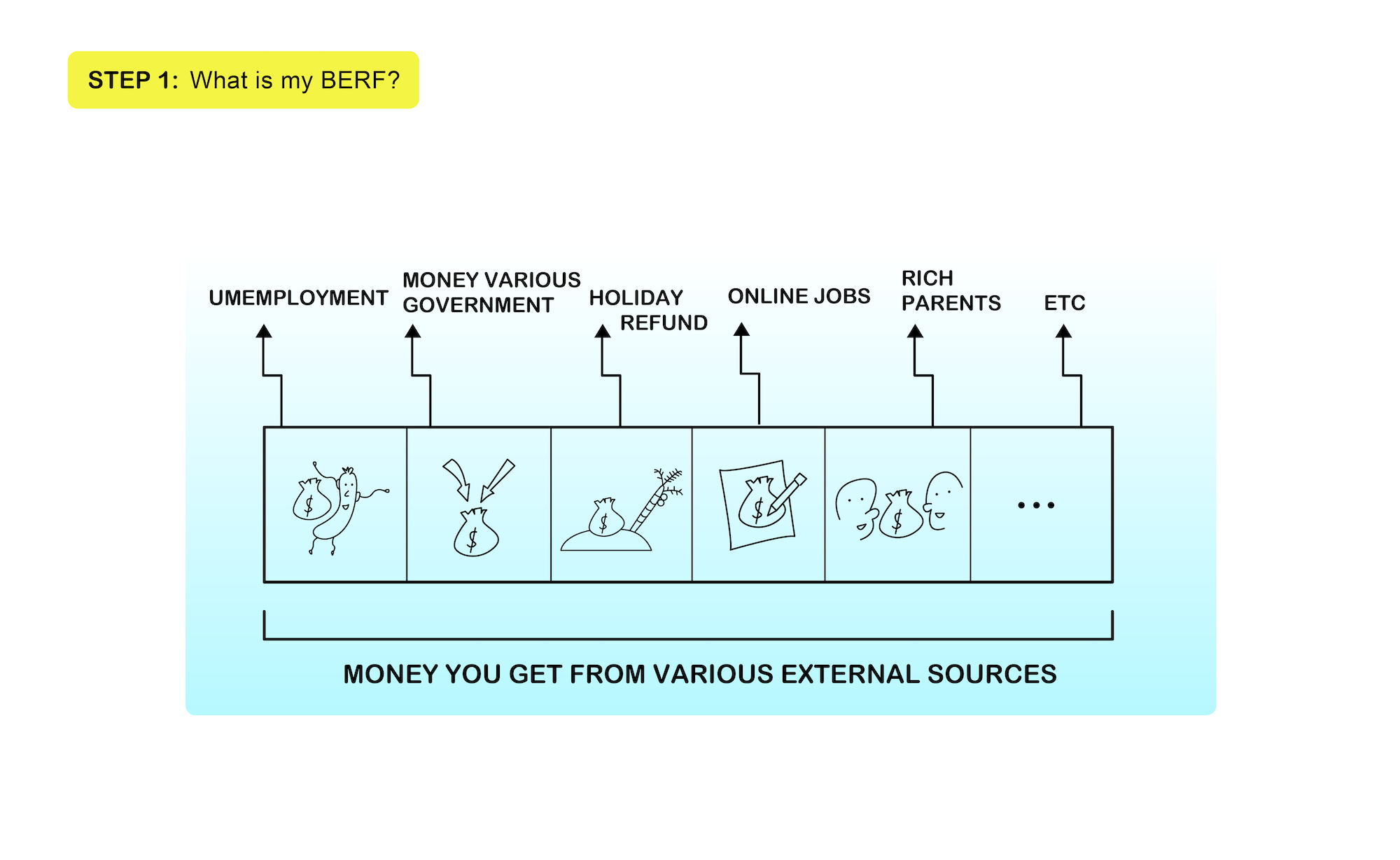

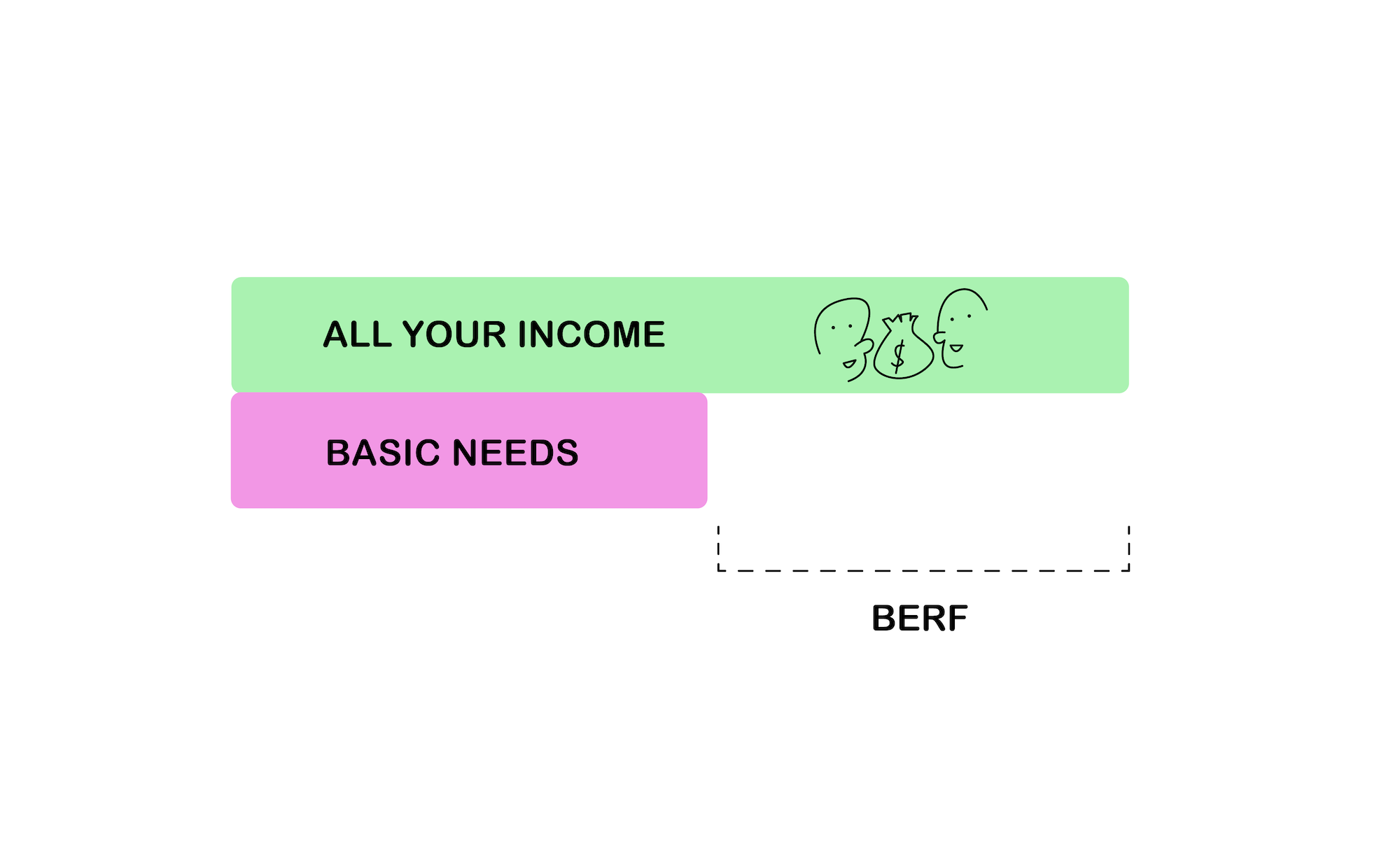

What counts as your Big Emergency Relief Fund (your BERF) will mean different things for everybody. It is basically what you have left over after your basic needs are covered, projected six months from now (which is an arbitrary time span). Let’s get started.

**** A note on the German IBB Sofort Hilfe money for freelancers:

1) it is only for business expenses / lost income

2) WE DO NOT KNOW WHAT WILL HAPPEN when tax season rolls around next year.

3) it is conceivable that the gov will want some of it back

4) it is not free money

SO PLEASE DO NOT BE RECKLESS WITH IT AND TRULY TREAT IT AS A BACKUP.

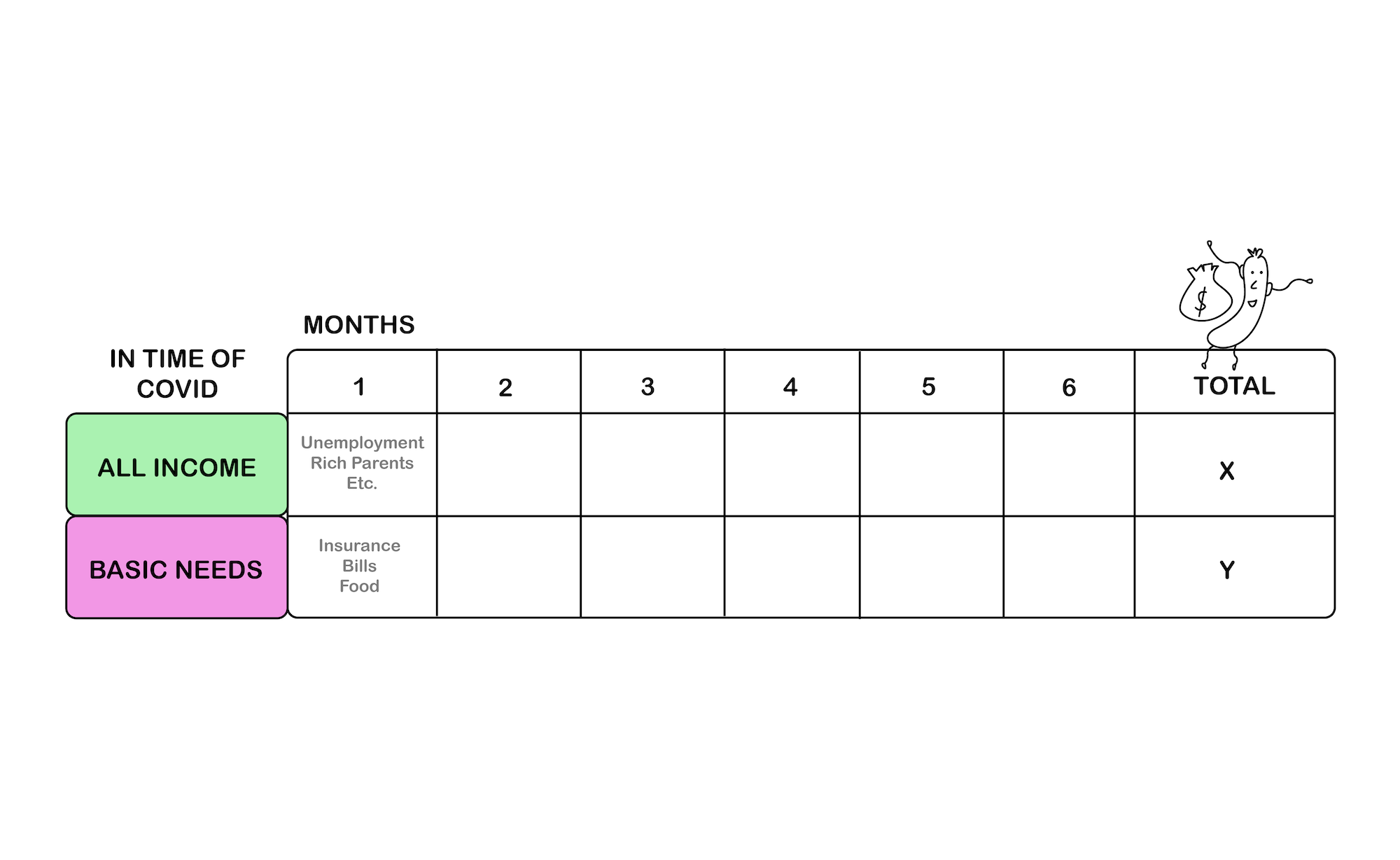

1a. How much money is available? A.k.a “what you actually have”

Take all the money you have right now (if you have a savings account already – good job!! – it’s up to you how much of it is “available”). Add it all together.

Then, add up any and all income that might be coming in later (your projected income). Maybe you have the kind of financial relationship with your parents/partner/caretaker where you can ask them for money. If so, then plan ahead now on how much you will ask them for and when, so that you can include that into your calculations. Maybe you know you will be getting unemployment money but it won’t come in for a couple months because you are waiting on a document or ID number. Maybe you have a plan to harass an airline to refund your cancelled flight, and you think you have a pretty good chance of getting paid back. Maybe you have an online job coming up.

1b: What are your basic needs? A.k.a “what you actually need”

This includes rent, bills, food, health insurance, and whatever else you know you can’t survive without. Add all the essential expenses up to make a monthly sum that you feel comfortable saying you cannot survive without.

Now, on to the graph.

With the help of the graph above, write your basic needs into the lower line. So let’s say your basic monthly needs are around 700 € – you would write 700 into each box, and in the boy marked “Y” would be 700 x 6 = 4200 €

In the all income line, you can include everything you currently have available in month 1, and then if you know you will get money later on, you can plot it accordingly. Add it all up and put it in the box “X.”

If the total in line X is greater than the total in line Y, then the difference between them is the size of your BERF. You can move on to the next step.

If the total in line X is less than the total in line Y, then you need to focus on ways to get money. Don’t panic, don’t judge yourself, don’t go numb. Even on a normal day it is difficult to look six months into the future and know that you will be alright. Think to yourself “ok, good to know. I need to get more money” and then start planning. How long can you survive with what you currently have? What are your emergency resources? Do you have friends who might like to help you out? Have you thought about crowdfunding? Does someone have a spare room? Do you need to write the boss of one of the projects that got cancelled, and see if they can pay you half of what they were going to, or give you an advance? Is there something you can make and sell, something you can teach or tutor, someone who needs care? Ask around, be open about being in a position of needing to receive money and opportunities. When more people know you are looking for money, more people can help you.

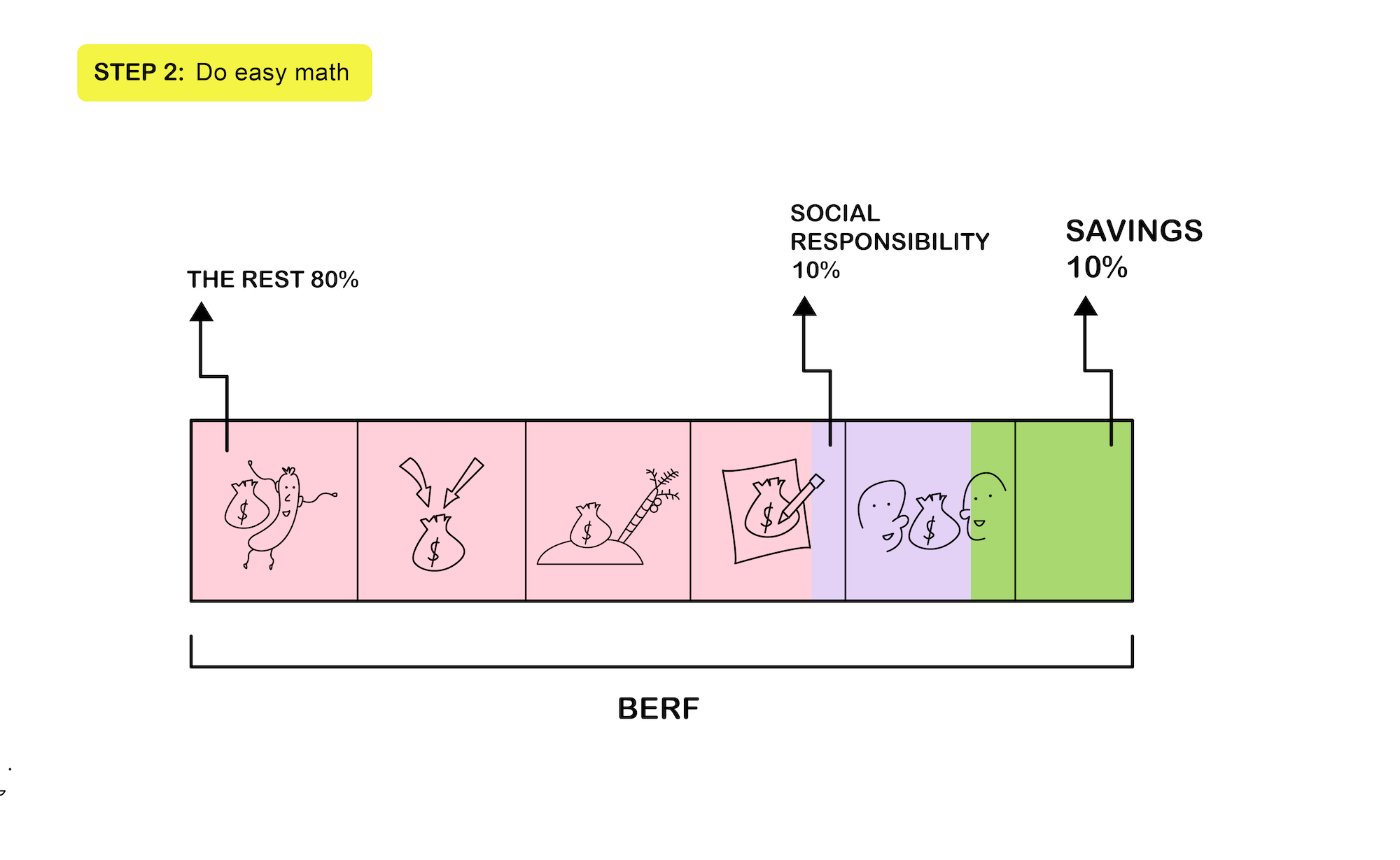

Take 10% of your BERF and call it “savings”

Take another 10% of your BERF and call it “social responsibility”

Take the 80% left over and call it “the rest”.

Ok. Let’s say your BERF was 2500 €. You would put 250 in savings, 250 intended to fulfill some social responsibility, and 2000 to do whatever you want with. Does this feel good to you? Do you feel comfortable with these numbers?

If it makes you stress and feel a bit tight, try doing 8% for savings and social, or 5% each.

If the result feel like you could be sharing and saving more, try 12% or 15% each.

Some of ‘the rest’ is a buffer and may end up covering a portion of your basic needs, so I wouldn’t spend it all right away, but essentially it is yours to do whatever you like with! Enjoy it. Feel great about spending it. Do some online shopping if you can afford it, get wine delivered to your home, buy curtains, or a juicer, or a synth, or whatever. It’s great to have money and you should buy things you like that feed you and nurture your soul.

A savings account is so so so important. Start one, even if all you have in there is 50 €. You can easily and freely make one at most banks. You might even be able to do it online. The idea is that it is an account separated from your day-to-day account, and you never, ever, take money from it. Every time you earn money, take 10% of it and put it in your savings. Right now is a great time to start one. Read more from Paco about savings accounts HERE.

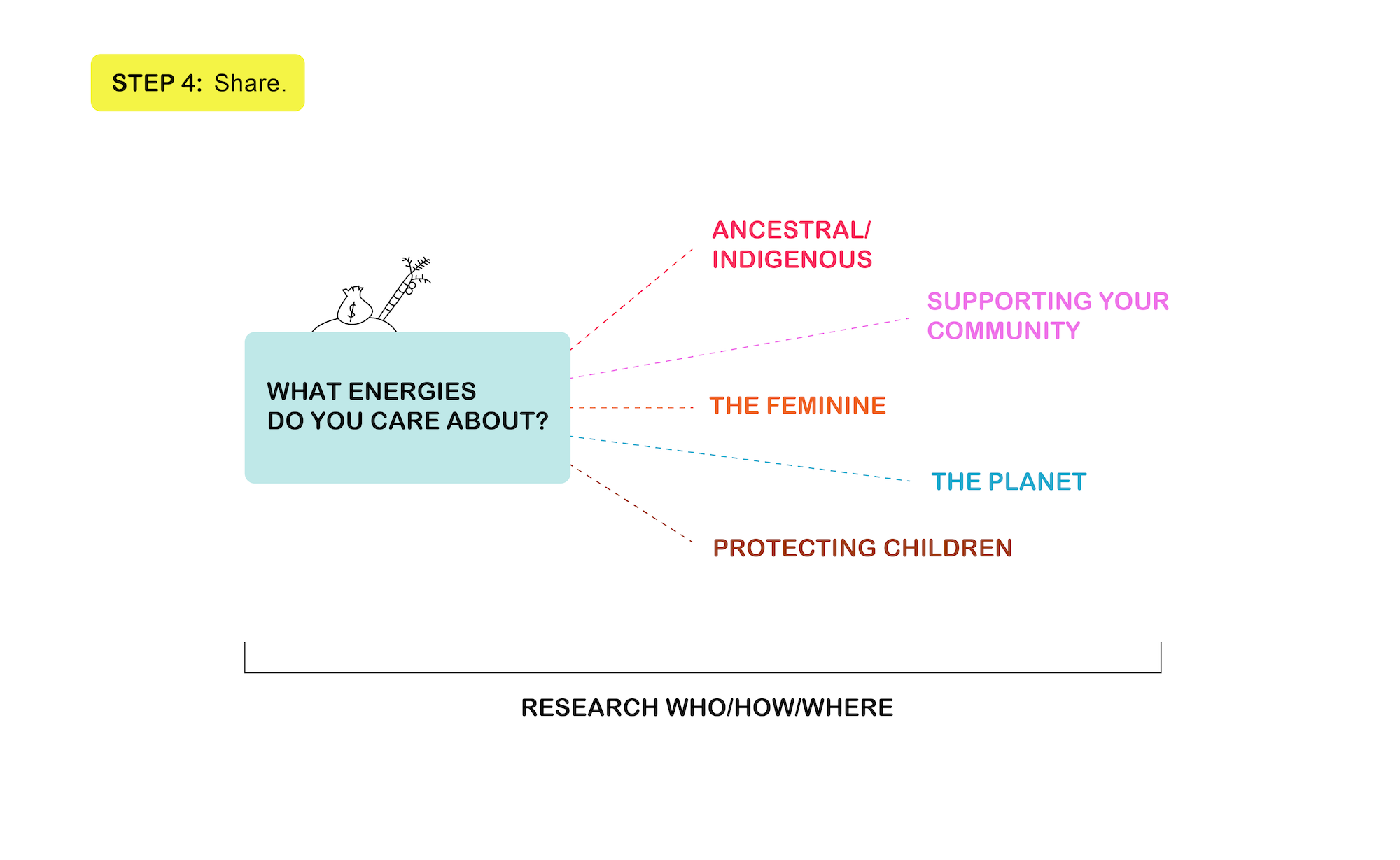

Start by asking yourself what kind of energy you care about. If you are thrown off by my use of the word “energy”, I encourage you to read this great piece by Denise Ferreira da Silva about the distribution of labor, movement, resource extraction, capital, and how all of these produce heat, which is energy, and which is in dire need of being circulated, redistributed, and de-accumulated.

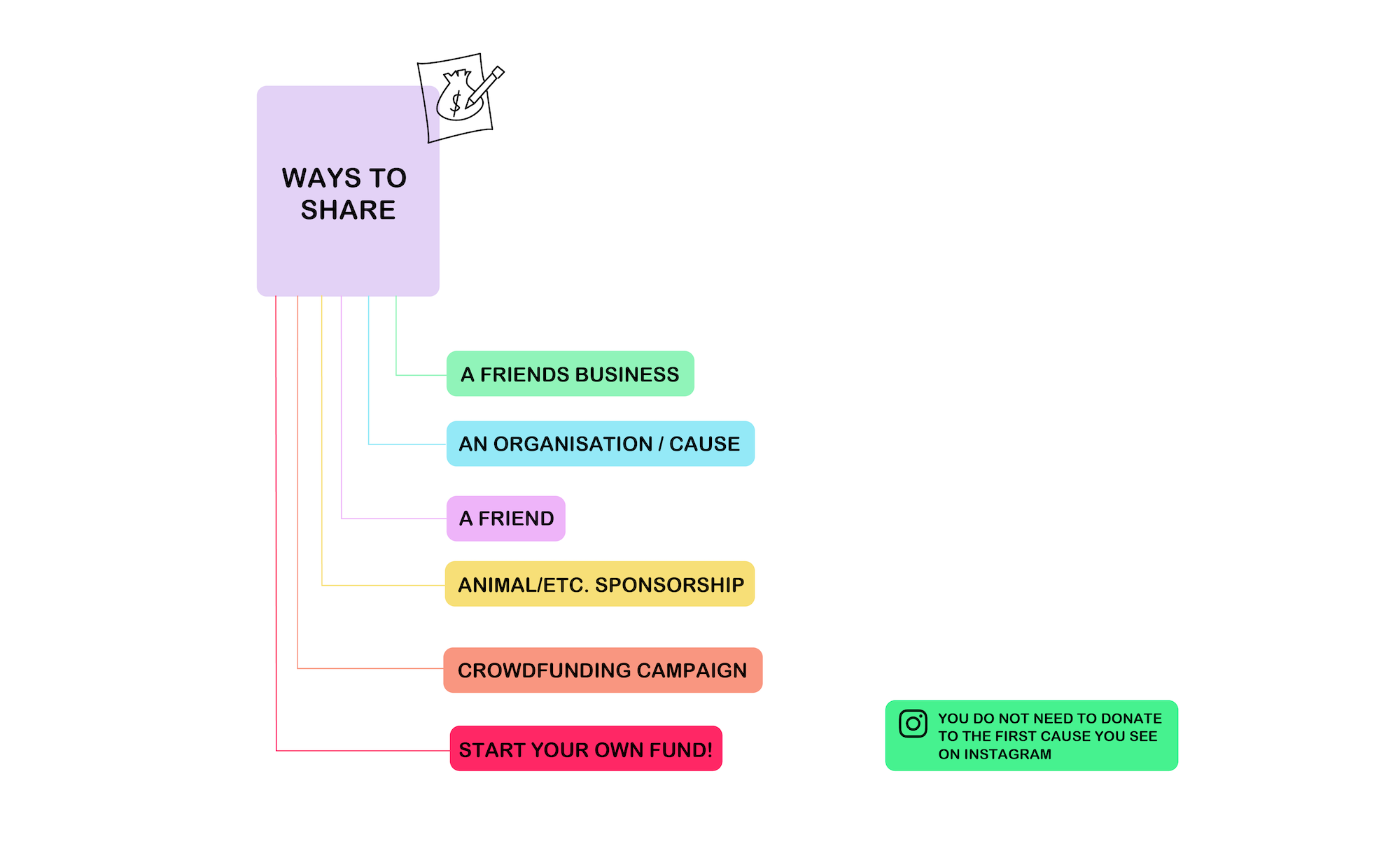

Then, you can start looking up cool ways to share – here are some ideas:

- a friend’s business: perhaps your friend runs a small business. This is a really hard time for small businesses, especially those run by queers, femmes, and people of color. Maybe you could buy some of their merch, make an order for a future date, or ask how you can help. Buy (as a gift for someone else, even) what under normal circumstances it seemed like a frivolous expense. It’s a win-win for you and your friend.

- an organization/cause: this is the obvious one. Most NGOs and charity organizations use a percentage of donation money to pay salaries and for administrative overhead, which is cool if you are cool with it, but do check out the specifics and email them with questions.

- a friend: perhaps you have a close friend who is undocumented, uninsured, who lives in a country that doesn’t offer social releif money, who just gave birth, recovered from surgery or illness, who has a lot of debt, or in any way doesn’t have a lot of safety structures around them. Without making it a big deal, ask them if they would be interested in talking about you giving them money. If they say yes, then talk about it. If they don’t, then let it go.

- sponsorship: there are lots of causes that will not be getting as much money for the next few years. For example, animal sponsorship and shelters for abused animals. You are entitled to share your money in whichever way you like, so if you would like to give 10€/month for the next 6 months to a donkey in Egypt, you should feel great about that.

- a crowdfunding campaign: This is still an amazing way to take care of your communities. Remember that all the problems that existed before still exist now, so keep an eye out for crowdfunding campaigns to help people recover from gender related harassment and abuse, to help mothers get doulas, or to help someone get a surgery when all this is done.

- Start a fund with friends: find a small group of people and pool your money together, deciding together what you want to donate it to. You can learn more ways to share money from each other, and have a bigger impact if you want to make a large donation to an organization.

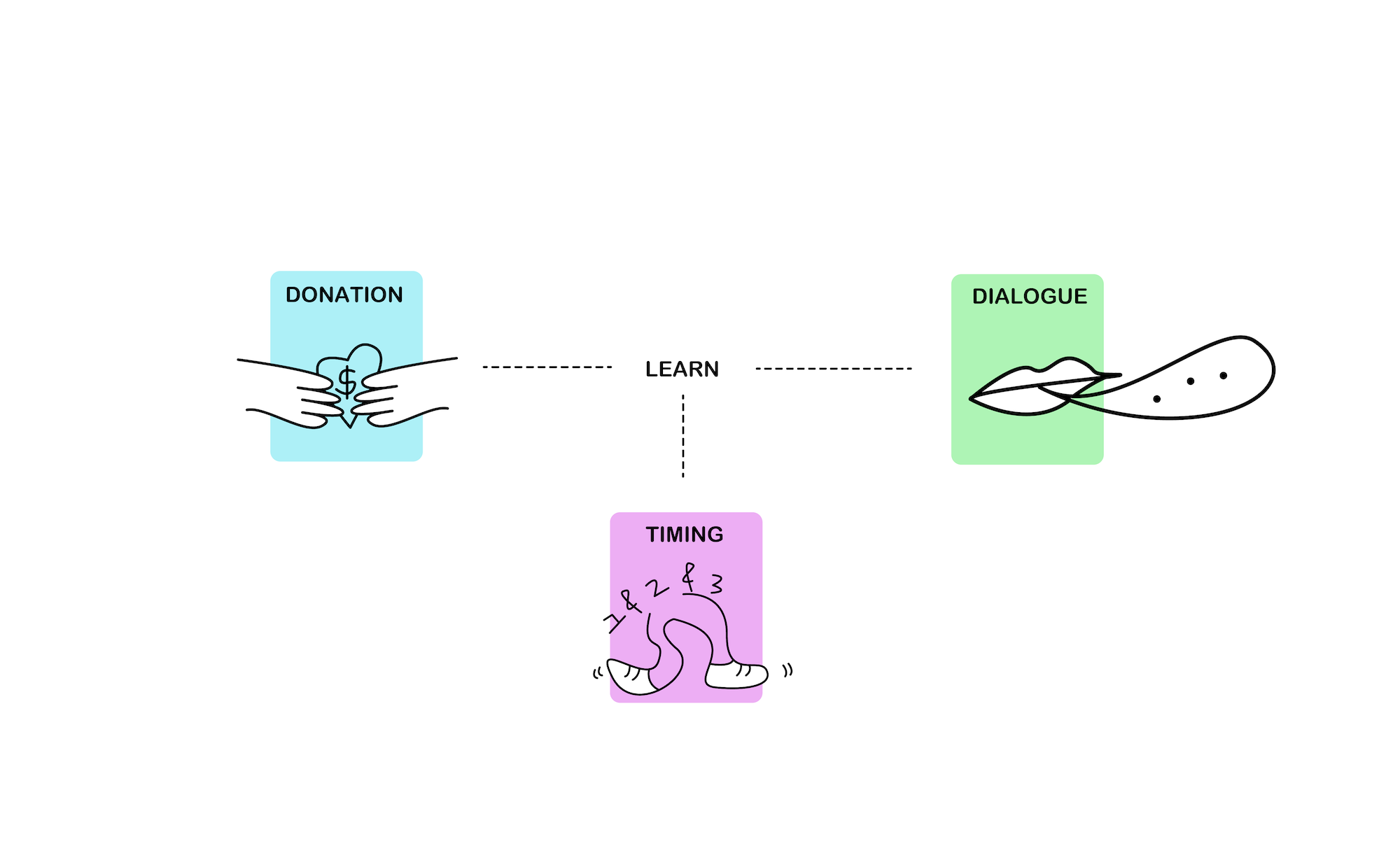

One of the coolest things about sharing money is that you LEARN A LOT – be it from researching alternative social support structures, to speaking to people in your community about how they are doing. Here are a few last things to think about.

Timing ~

A spike in donations is typical in times of crisis, which we have to understand in conjunction with the media. One day, not too long from now, the media will turn away from COVID-19 and start to talk about other stuff. However, people will be affected by this crisis for much much longer than it is ‘newsworthy’ to talk about. Therefore you could also decide to save your social responsibility fund for six months from now (maybe store it in your savings account so you don’t touch it).

Talking to friends ~

Giving money to each other directly can be complicated due to belief systems, power dynamics, and cultural approaches to money. There is no how-to guide I could write that could help you navigate this rocky but ultimately beautiful terrain. Instead, here are some guiding principles –

- If you give money to a friend, give without condition

- If your friend does not want the money, there is nothing you can do about that

- You should ideally try to determine the amount together, and before that conversation happens you should have a range in mind already so you know your limits and don’t end up feeling overextended

- After you give money, remember that you have no control over what they do with it, so if you say here is 50 for groceries, and instead they end up spending it on something else, that’s fine! The point is that you had the talk, and gave and received in good faith.

Donation ~

Remember that charity donations are tax-deductible, so save those e-receipts!

In conclusion, think of this as a journey of self-discovery, rather than shame, guilt, or self-hate. Sharing should feel good. Do the math. Come to a number that sings.

Cheat sheet of all the graphics for download here!

Words by Louise Trueheart

Graphics by Nico Limo

Louise Trueheart is a dancer and writer based in Berlin, as well as a part of COVEN. When she isn’t editing this magazine, Louise navigates the European dance and performance milieu, proffers her esoteric therapy service ‘Careapy’, translates from French to English, and wants a dog.

Nico Limo is a multidisciplinary designer based in Berlin and the internet. Beyond visual design they also work with design thinking, music, sound production, and organise queer dance parties.